More on Technology

Innominds and Qualcomm Collaborate to Drive Enterprise Digital Transformation with High-Compute Edge AI Platform

-

Team Eela

Data modernization in the banking and finance sector takes on new urgency as administrative changes and pressure continues to increase the cost and complexity of managing legacy unit. Banks should make several informed decisions to reap the benefits of data modernization in fintech companies. Some of these include preventing cyber-attacks, improving customer experience, decreasing risk, and using big data for fraud detection.

With the exponential growth of data, companies need to upgrade their systems to effectively manage and analyze data, gain insights, and make informed decisions. Data modernization enables businesses to adopt new technologies, such as artificial intelligence and machine learning, to help automate processes, improve efficiency, and discover new opportunities.

Efforts to handle data, such as data integration and analytics, can help businesses make the most of their data as a valuable resource. This is done by moving away from inflexible systems that keep data isolated and enhancing the value of data. Data modernization is a crucial part of these efforts, which addresses issues related to outdated data management software.

Data modernization initiatives are applied in several sectors, but they are becoming more important for banking and financial organization than ever.

It is not just about incorporating new systems to ensure compliance but investing in innovation and better products and services. For instance, banks are continually trying to deliver better services and reduce costs. Banks are shifting away from addressing financial value alone and are including ESG (environmental, social, and governance) in their data. This facilitates data modernization and investment in bank innovation, governance, and efficiency.

Administrative policies are forcing companies to change and innovate; data modernization strategies are the key to accomplishing that. These policies demand more granular data and improved relevance of submissions. This means data modernization is at the core of any company’s transformation. Moreover, the right data modernization strategy can help companies to increase their business value. The two main areas that are gaining more interest in BFS companies are digitalization and cloud adoption programs.

For banks, data modernization is about creating new systems which allow better products and innovation while ensuring compliance without risk. Data modernization was slow for decades, specifically in finance and risk operations. This is common among banks sticking to their tried and tested technology infrastructure along with legacy systems rather than using modernized technology.

When practicing data modernization, a bank’s representative team must prioritize the project based on outcomes like decreased enterprise-wide risk and increased revenue. The process must be phased to meet the bank’s objectives.

Banks are trying to meet their customer demand, cope with changing guidelines, and fight pure digital fintech challenges. Banks today must realize they hold significant value in their users’ financial profiles by appreciating data transformation. Moreover, although bank transformation is significantly challenging, if executed properly can gain more benefits that were based on legacy systems.

Banks must leverage vast amounts of data in today’s interconnected world, where consumers are increasingly tech-savvy. Open banking has made collecting data from diverse sources, including specialized databases, easier. Moreover, technological advancements have enabled relationship managers to access artificial intelligence tools, facilitating personalized customer service and cost reduction. By embracing these technologies, banks can future-proof their operations, generate new revenue streams, and remain competitive.

However, modernizing a core banking system is a complex process that requires careful planning. It begins with defining business objectives, customer needs, and regulatory requirements. Then, it is necessary to identify the key functionalities of the core system and determine the target operating model and IT architecture. Despite the challenges and significant investment required, a modernized core banking system can transform an entire business, making the investment worthwhile.

In today’s digital age, where more data is available online, banks have an opportunity to become even more relevant to their customers. To stay ahead of their competitors, banks must offer customer-centric services that enhance the overall customer experience. By leveraging the wealth of data, banks can better aggregate customer information to understand their needs and preferences. This approach improves customer satisfaction and helps banks control costs and boost their performance.

Customer data is essential to create customized end-to-end experiences that expand customer wallet share. To achieve this, banks must adopt a more personalized approach. Personalization has become a crucial factor for banks in the digital era. Digital banks are leading the way, with 83 percent citing customer centricity as a driving factor for key decisions. Moreover, most digitally-aware banks are increasing their investment in personalized experiences to meet the demands of their customers.

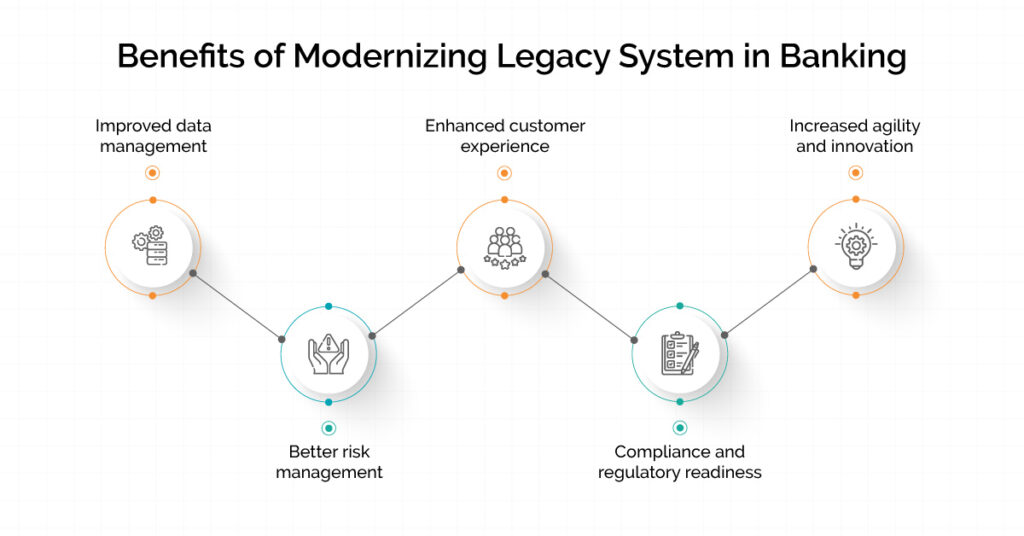

Data modernization offers several benefits to banking institutions, such as:

Upgrading to a modern data-driven system is not possible without disrupting internal processes. Some of the key challenges to data modernization are:

Data modernization is a challenging process that can offer several benefits to businesses. Knowing when to get rid of the legacy system can make a massive difference in the competitive world of digital banking. Moreover, advanced banking offers security features that meet compliance standards.

More on Technology